Owners of homes who don’t reside in high-risk flood zones probably don’t give flood insurance much thought. After all, properties near rivers and lakes or in hurricane-prone locations should get flood insurance. In fact, if there is even a remote possibility that their home could flood, homeowners should seriously consider having this type of specialty insurance. Why? While some types of water damage may be covered by homeowner’s insurance and home warranties, damage from floods is typically not included in renters’, homeowners’, or hazard insurance plans.

- 1. Flood Insurance

- 2. Best Flood Insurance United States (US)

- 3. Neptune – United States (US)

- 4. Assurant – United States (US)

- 5. The Flood Insurance Agency – United States (US)

- 5.1 Why Its Highly Recommended – The Flood Insurance Agency United States (US)

- 5.2 Pros & Cons – The Flood Insurance Agency United States (US)

- 5.3 Company Overview – The Flood Insurance Agency United States (US)

- 5.4 Products & Services – The Flood Insurance Agency United States (US)

- 5.5 Contact Details – The Flood Insurance Agency United States (US)

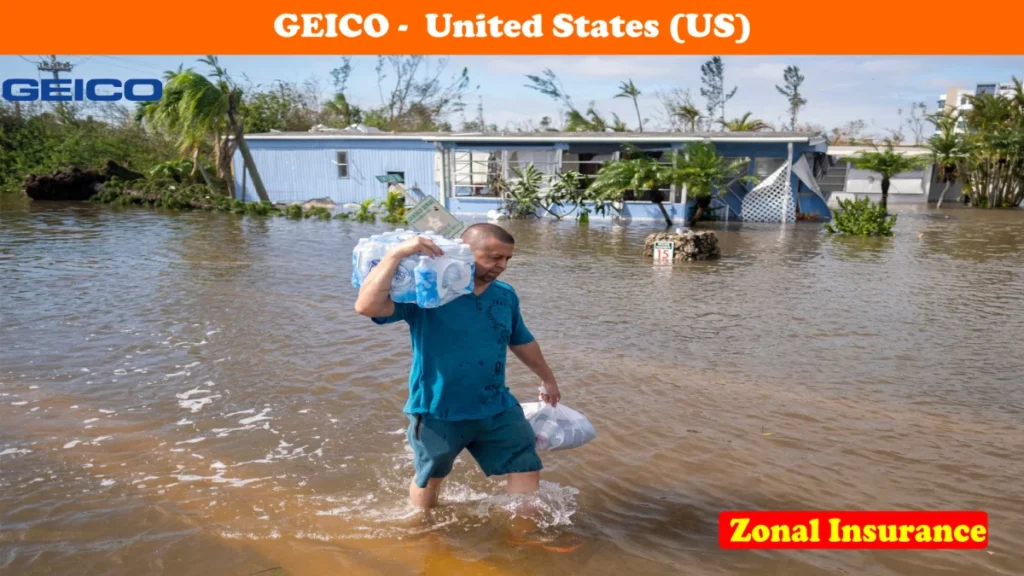

- 6. GEICO – United States (US)

- 7. Allstate – United States (US)

- 8. USAA – United States (US)

- 9. Flood Simple Insurance Services – United States (US)

- 9.1 Why Its Highly Recommended – Flood Simple Insurance Services United States (US)

- 9.2 Pros & Cons – Flood Simple Insurance Services United States (US)

- 9.3 Company Overview – Flood Simple Insurance Services United States (US)

- 9.4 Products & Services – Flood Simple Insurance Services United States (US)

- 9.5 Contact Details – Flood Simple Insurance Services United States (US)

- 10. Chubb – United States (US)

- 11. Wright Flood – United States (US)

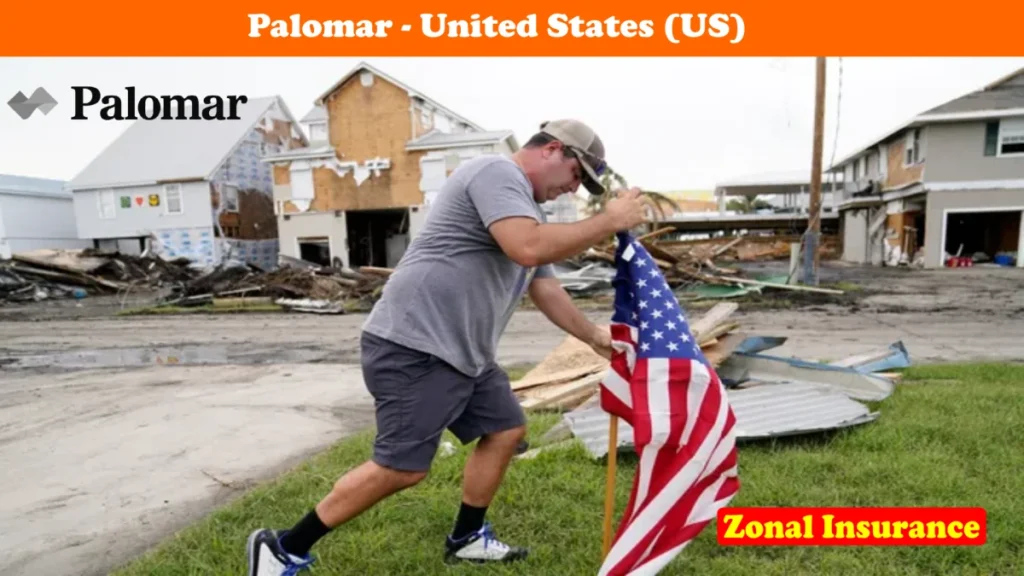

- 12. Palomar – United States (US)

- 13. FAQs – Flood Insurance United States (US)

- 14. Conclusion – Flood Insurance United States (US)

Additionally, if the home is situated in a region with a high risk of flooding and the owner has a mortgage that is supported by the government, most certainly, they must have flood insurance.

Even homeowners who don’t live in a high-risk flood zone or don’t have a government-backed mortgage may be forced to obtain flood insurance by their mortgage lender. Homeowners must therefore comprehend what flood insurance is, what coverage it offers, and which providers supply the best flood insurance.

1. Flood Insurance

Property damage from flooding, which is frequent in locations prone to floods, is covered by flood insurance. It is frequently offered through the National Flood Insurance Program in the US (NFIP). Although there are some exclusions, it covers damage to buildings and possessions. Prices vary depending on location and coverage limits.

You could need flood insurance if you have a federally regulated mortgage in a high-risk area. Planning ahead is essential because there is typically a 30-day waiting period after purchase before coverage begins. In the event of flood damage, you must submit a claim to your insurance company.

1.1 Need for Flood Insurance

In the US, having flood insurance is essential, especially for people who live in flood-prone areas. It offers crucial defense against the catastrophic financial damages that flooding incidents might cause. Flood insurance guarantees that homeowners and businesses have the required financial support to recover from flood-related losses, restore their properties, and replace destroyed possessions because standard homeowners’ insurance often does not cover flood damage. It serves as an essential safeguard in flood-prone areas, providing comfort and financial stability in trying times.

2. Best Flood Insurance United States (US)

Floods are not typically covered by homeowner’s insurance policies. Thanks to the National Flood Insurance Program (NFIP), which is run by the Federal Emergency Management Agency (FEMA), homeowners can purchase flood insurance from either private companies or the NFIP.

2.1 Top Flood Insurance Companies United States According To Our Rating

Based on plan options, costs, coverage, customer satisfaction, and AM Best financial stability rankings, we examined and evaluated many flood insurance providers. The top ten businesses for your various needs are listed below.

- Best for Comprehensive Coverage: Neptune

- Best Affordable Option: Better Flood Insurance

- Best Commercial Flood Insurance: The Flood Insurance Agency

- Best Overall: GEICO

- Best for NFIP coverage: Allstate

- Best for Veterans: USAA

- Best for Customer Service: Flood Simple Insurance Services

- Best for high-value homes: Chubb

- Best for affordable rates: Wright

- Best for excess flood insurance: Palomar

3. Neptune – United States (US)

3.1 Why Its Highly Recommended – Neptune United States (US)

Neptune is our top pick for comprehensive coverage because it can customize your policy to cover more of your assets than any other insurer.

3.2 Pros & Cons – Neptune United States (US)

| Pros | Cons |

| Online residential price calculator | claims to be a tech innovator yet only accepts claims submitted by phone |

| Available everywhere but Alaska and Kentucky. | |

| Includes assets that other insurers will not |

3.3 Company Overview – Neptune United States (US)

The 2016-founded company Neptune Flood develops sophisticated algorithms for pricing flood risk using cutting-edge mapping technology and aerial remote sensing. Households in all designated flood zones can adopt this cutting-edge strategy, which provides better protection and cost savings than the National Flood Insurance Program. The insurance offered by Neptune Flood are supported by Lloyd’s of London, have a “A” rating from A.M. Best, and are accessible in all designated flood zones.

| Industries | Analytics Insurance Mapping Services |

| Headquarters Regions | Tampa Bay Area, East Coast, Southern US |

| Founded Date | 2016 |

| Founders | Bill Martin, Jim Albert |

3.4 Products & Services – Neptune United States (US)

The following coverages are available from Neptune to protect your house, your belongings, and other costs associated with flood damage.

- Dwelling

- Personal property

Additional Coverages

| Other structures |

| Loss of use |

| Basement contents |

| Pool repair and refill |

| Debris removal |

| Loss avoidance measures |

| Increased cost of compliance |

3.5 Contact Details – Neptune United States (US)

You can contact company through,

| Phone Number | 1-877-420-3689 |

| Address | St. Petersburg, Florida, United States |

| [email protected] | |

| Official website | https://neptuneflood.com/residential-flood-insurance/ |

4. Assurant – United States (US)

4.1 Why Its Highly Recommended – Assurant United States (US)

Assurant provides homeowners with comprehensive flood insurance coverage, including NFIP and private add-on policies. With online policy quotes, homeowners can estimate coverage costs. Although high, Assurant offers competitive prices and expedites claims processes. The FlexCash program allows homeowners to receive up to $10,000 for travel and hotel costs.

4.2 Pros & Cons – Assurant United States (US)

| Pros | Cons |

| Online quote and claims process that is simplified | Pricing could be more expensive than those of rivals. |

| The FlexCash program offers discretionary cash up to $10,000. | |

| Private flood insurance is obtainable for versatile coverage. |

4.3 Company Overview – Assurant United States (US)

Assurant, Inc. is a global provider of risk management products and services, headquartered in Atlanta. It offers specialty insurance products in property, casualty, extended device protection, and preneed sectors. Assurant, formerly Fortis, Inc., is 325 on the Fortune 500 list of the largest US companies by revenue as of 2022.

| Industry | Insurance |

| Founded | 1892; 131 years ago |

| Headquarters | Atlanta, U.S. |

| Area served | Worldwide |

4.4 Products & Services – Assurant United States (US)

Following services offered by the company are,

- National Flood Insurance Program

- Private Flood Product Suite

- Technology & Agent Logins

- FlexCash

4.5 Contact Details – Assurant United States (US)

You can contact company through,

| Phone Number | 1-800-423-4403 |

| Address | 260 Interstate N Circle SE. Claims, 8th Floor. Atlanta, GA 30339 |

| [email protected]. | |

| Official Website | https://www.betterflood.com |

5. The Flood Insurance Agency – United States (US)

5.1 Why Its Highly Recommended – The Flood Insurance Agency United States (US)

The Flood Insurance Agency (TFIA) is the finest option for commercial flood insurance due to its transparency. You can customize your coverage outside the NFIP’s restrictions, examine what they cover and do not cover, estimate your costs using a feature-rich online calculator, and receive the same or better coverage for less money.

5.2 Pros & Cons – The Flood Insurance Agency United States (US)

| Pros | Cons |

| National coverage excluding Kentucky and New York | Properties in Coastal Barrier Resource Act (CBRA) zones, non-FEMA communities, mobile homes, or condominium units are not eligible. |

| Online calculator for estimates | Does not cover homes that have suffered multiple flood losses within the previous five years |

| For less money, get more protection than the NFIP offers. | Does not apply to real estate that FEMA has designated as a Serious Repetitive Loss property. |

| There are rate-locking programs. |

5.3 Company Overview – The Flood Insurance Agency United States (US)

For both individuals and businesses, the Flood Insurance Agency offers a variety of flood insurance options.

| Industries | Auto Insurance Insurance Property Insurance |

| Headquarters Regions | East Coast, Southern US |

| Founded Date | 2008 |

5.4 Products & Services – The Flood Insurance Agency United States (US)

Services offered by the company are,

- Flood FLEX

- Flood Ready

5.5 Contact Details – The Flood Insurance Agency United States (US)

You can contact the company through,

| Phone Number | +1877-356-6348 |

| Address | The Flood Insurance Agency 5700 SW 34th St Ste 402-B Gainesville, FL 32608 |

| [email protected] | |

| Official Website | https://privatemarketflood.com |

6. GEICO – United States (US)

6.1 Why Its Highly Recommended – GEICO United States (US)

GEICO is the finest flood insurance provider overall thanks to its strong financial position to back up its claims, excellent customer satisfaction scores, and online quote and policy access capabilities.

6.2 Pros & Cons – GEICO United States (US)

| Pros | Cons |

| Online calculator for quotes | Underwriting of policies by third parties |

| Claims can be made by phone. | A small number of special discounts |

| Savings for combining with homeowner’s or auto insurance | Pricing varies according to the specific partner business they work with. |

| A mobile app that allows users to request a quote |

6.3 Company Overview – GEICO United States (US)

In order to provide insurance for military members and government employees, GEICO was founded in 1936 during the Great Depression. Actually, it is referred to by its full name, Government Workers Insurance Company. It has been a completely owned indirect subsidiary of Berkshire Hathaway since 1996. “Geico History,” Geico.

The ratings for GEICO are A++ (Superior) from AM Best, AA+ from Standard & Poor’s, and Aa2 from Moody’s.

As GEICO sells NFIP plans, you will leave with a FEMA policy rather than one from GEICO. To find out how much your flood insurance will cost, you can either phone and speak to a live representative or get an online quotation. Call a live agent at the business of your GEICO partner carrier to file a claim.

| Industry | Insurance |

| Founded | 1936; 87 years ago San Antonio, Texas, United States |

| Founders | Leo Goodwin Sr. Lillian Goodwin |

| Headquarters | Chevy Chase, Maryland, United States |

6.4 Products & Services – GEICO United States (US)

Flood insurance protects your home and personal property from flood damage, typically caused by long, heavy rain. It’s also available for condos or rentals. However, it’s important to be aware of other water damage risks, such as pipe bursts, not typically covered by flood policies.

6.5 Contact Details – GEICO United States (US)

You can contact company through,

| Phone Number | 800-841-3005 |

| Mailing Address | GEICO Emergency Road Service P.O. Box 8075 Macon, GA 31208-8075 |

| [email protected] | |

| Official Website | https://www.geico.com/ |

7. Allstate – United States (US)

7.1 Why Its Highly Recommended – Allstate United States (US)

Due to its vast agent network, good educational materials, online policy administration, and additional flood insurance alternatives provided by National General, a subsidiary of Allstate, it is our top choice for National Flood Insurance (NFIP) policy management.

7.2 Pros & Cons – Allstate United States (US)

| Accessible in all 50 states as well as Washington, D.C. | A 30-day waiting period is required before coverage kicks in. |

| Fewer than average customer complaints | Limiting maximum amounts of coverage |

| National General offers private flood insurance in various states | Minimal maximum deductible sums |

7.3 Company Overview – Allstate United States (US)

American insurance firm The Allstate Corporation has had its main office in Glenview, Illinois (with a Northbrook, Illinois address) since 2022. It was originally established in 1931 as a division of Sears, Roebuck and Co. It was spun off in 1993 but remained partially owned by Sears until June 1995, when it became a fully independent business. In Canada, the company also offers personal lines insurance.

Allstate is a sizable business, and the 2019 Fortune 500 list of the biggest American companies by total sales placed them at number 79 with revenues of $39.8 billion in 2018.

| Industry | Insurance |

| Founded | April 17, 1931; 92 years ago |

| Headquarters | Northbrook, Illinois, U.S. |

7.4 Products & Services – Allstate United States (US)

To safeguard your house, your belongings, and other costs associated with flood damage, Allstate offers the following coverages.

- Dwelling

- Personal property

Additional Coverages

- Debris removal

- Loss avoidance measures

- Increased cost of compliance

- Condominium loss assessments

7.5 Contact Details – Allstate United States (US)

You can contact company through,

| Phone Number | 800-726-6033. |

| Address | 2775 Sanders Road North Plaza Northbrook, IL 60062-6127 USA |

| [email protected] | |

| Official Website | https://www.allstate.com/ |

8. USAA – United States (US)

8.1 Why Its Highly Recommended – USAA United States (US)

In order to customize its flood policy offerings to your needs, USAA offers flood insurance through FEMA’s NFIP program, which offers federally-backed flood insurance policies to homes, as well as through its broker network for excess coverage. USAA is the finest flood insurer for veterans because of its flexible policy options and significant member reimbursements.

8.2 Pros & Cons – USAA United States (US)

| Pros | Cons |

| Easy access with a mobile app | There is no choice for a local agency. |

| Offered in all states | Exclusively accessible to family members of U.S. service men and veterans |

| Veteran-specific insurance |

8.3 Company Overview – USAA United States (US)

Our choice for the best flood insurance provider for veterans, active duty personnel, and their families goes to USAA because it provides a variety of insurance types tailored for members of the armed forces of any rank and their families and gives its members a share of the annual savings on its claims budget.

In order to insure one another’s cars, 25 army officers founded USAA in 1924.

It offers services in all 50 states and Washington, D.C. 7 AM it has an A++ (Excellent) rating from Best.

| Industry | Banking Financial services Insurance |

| Founded | June 20, 1922; 101 years ago |

| Headquarters | San Antonio, Texas United States |

8.4 Products & Services – USAA United States (US)

Flood insurance covers following things,

- Appliances and cabinets

- Carpet and flooring

- Electrical and plumbing systems

- Heating and air systems

- Furniture

- Clothes

- Electronics

- Some valuables like jewelry and artwork

8.5 Contact Details – USAA United States (US)

You can contact company through,

| Phone Number | 00 1 800-531-8722 |

| Address | USAA 9800 Fredericksburg Rd. San Antonio, TX 78288 |

| [email protected] | |

| Official Website | http://www.usaa.com/ |

9. Flood Simple Insurance Services – United States (US)

9.1 Why Its Highly Recommended – Flood Simple Insurance Services United States (US)

Customers really praise Flood Simple Insurance Services’ online rapid price estimates and other conveniences, which is why we’ve chosen it as the finest customer service provider.

9.2 Pros & Cons – Flood Simple Insurance Services United States (US)

| Pros | Cons |

| Highest online customer ratings | Policies are ineligible for nine states. |

| Online tool for instant quotation | |

| Legislation in 41 states | |

| The company’s stated goal is to significantly simplify the purchase of flood insurance. |

9.3 Company Overview – Flood Simple Insurance Services United States (US)

Flood Simple Insurance Services, which has its corporate headquarters in Denver, Colorado, and is supported by Lloyd’s of London, offers strong financial standing along with well-regarded client service.

“Flood simple,” from number five.

They provide residential flood insurance for owner-occupied and renter-occupied homes, condos, duplexes, townhouses, and triplexes in addition to commercial flood insurance for commercial structures. Because they can provide quotes promptly and can save you even more money if you combine it with their homeowner’s insurance policy, the company is the greatest option for owners of these kinds of residential properties.

| Industries | Customer Service Financial Services Insurance Risk Management |

| Headquarters Regions | Greater Denver Area, Western US |

| Founders | Stephen Schramke |

9.4 Products & Services – Flood Simple Insurance Services United States (US)

They provide residential flood insurance for owner-occupied and renter-occupied homes, condos, duplexes, townhouses, and triplexes in addition to commercial flood insurance for commercial structures. Because they can provide quotes promptly and can save you even more money if you combine it with their homeowner’s insurance policy, the company is the greatest option for owners of these kinds of residential properties.

9.5 Contact Details – Flood Simple Insurance Services United States (US)

You can contact company through,

| Phone Number | 844-803-8788 |

| Address | 1624 Market Street, Suite 230 ECM 22340 Denver, CO 80291 |

| [email protected] | |

| Official Website | https://floodsimple.com/ |

10. Chubb – United States (US)

10.1 Why Its Highly Recommended – Chubb United States (US)

Because to its outstanding financial stability and more than a century of experience designing policies to meet the needs of its high net worth clientele, Chubb is the market leader in offering comprehensive and individualized flood insurance for expensive residences.

10.2 Pros & Cons – Chubb United States (US)

| Pros | Cons |

| Building coverage of up to $15 million | Rates may be too high. Individualized flood insurance for expensive residences. |

| wide-ranging policy options | |

| 10 days without a mortgage required, or no waiting period if acquired for a mortgage. |

10.3 Company Overview – Chubb United States (US)

An American business called Chubb Limited was established in Zürich, Switzerland. It is the parent firm of Chubb, the biggest publicly traded property and Casualty Company in the world, which offers insurance products encompassing property and casualty, accident and health, reinsurance, and life insurance.

Chubb is active in the London insurance market at Lloyd’s and in 55 other nations and territories. Chubb’s clients include local and international companies, as well as individuals and insurers looking for reinsurance coverage. Chubb offers life insurance, reinsurance, commercial and personal property and casualty insurance, as well as personal accident and supplemental health insurance.

| Industry | Insurance and reinsurance |

| Founded | 1985; 38 years ago in Hamilton, Bermuda |

| Founder | Thomas Caldecot Chubb |

| Headquarters | Zürich, Switzerland |

10.4 Products & Services – Chubb United States (US)

Basic coverages

- Dwelling

- Personal property

Additional Coverages

- Other structures

- Loss of use

- Replacement cost contents

- Basement property

- Basement contents

- Debris removal

- Loss avoidance measures

- Increased cost of compliance

10.5 Contact Details – Chubb United States (US)

You can contact company through,

| Phone Number | +1 800-352-4462 |

| Address | 436 Walnut St, Philadelphia, PA 19106, United States |

| [email protected]. | |

| Official Website | https://www.chubb.com/ |

11. Wright Flood – United States (US)

11.1 Why Its Highly Recommended – Wright Flood United States (US)

One of the biggest flood insurance providers in the United States, Wright Flood offers both affordable private flood insurance options and NFIP through Wright National Flood Insurance Services and its partner companies.

11.2 Pros & Cons – Wright Flood United States (US)

| Pros | Cons |

| On the private sector, one of the cheapest solutions for flood insurance | Who to contact to amend or cancel your policy might not be apparent |

| Provides a diverse range of insurance alternatives from numerous different firms |

11.3 Company Overview – Wright Flood United States (US)

ResiFlood was introduced in 2020 by Wright, a well-known provider of flood insurance, and it offers coverage of up to $1 million with no waiting period. Additional coverages include loss of use, building ordinance protection, and replacement cost claim payouts are included in the state-admitted private flood insurance policy.

Wright wants to bring ResiFlood to more states even though it’s now only available in 12 of them. Wright may offer flood insurance through the NFIP or one of its excess and surplus lines carriers if the standalone private flood insurance option is not a possibility.

| Industries | Finance Insurance Professional Services |

| Headquarters Regions | Tampa Bay Area, East Coast, Southern US |

| Founded Date | 1983 |

11.4 Products & Services – Wright Flood United States (US)

Basic Services Offered

- Dwelling

- Personal property

Additional Coverages

- Other structures

- Loss of use

- Replacement cost contents

- Ordinance or law

11.5 Contact Details – Wright Flood United States (US)

You can contact company through,

| Phone Number | 1.800.820.3242 |

| Address | P.O. Box 33064, St Pete, FL 33733 |

| [email protected] | |

| Official Website | http://www.wrightflood.com/ |

12. Palomar – United States (US)

12.1 Why Its Highly Recommended – Palomar United States (US)

For individuals with NFIP policies who require additional coverage, Palomar offers the best and most economical excess flood insurance due to its high available coverage levels and readiness to insure residences in any flood zone.

12.2 Pros & Cons – Palomar United States (US)

| Pros | Cons |

| Option for affordable and complete excess flood insurance | Available only in 18 states |

| There is no wait time |

12.3 Company Overview – Palomar United States (US)

Palomar provides flood insurance in 30 states with no waiting period, offering up to $5 million for home and $1 million for personal belongings. It is suitable for high-risk flood zones with a high-deductible policy. However, it doesn’t cover basement personal belongings or swimming pools, which are valuable additional coverages found with other private carriers.

12.4 Products & Services – Palomar United States (US)

Damage to your house, other buildings, personal possessions, extra living costs, and lost rent if your house is uninhabitable while repairs are being made are all covered by Palomar flood insurance. Palomar provides optimum protection against flood damage by offering coverage of up to $5 million.

- Dwelling limit up to $5 million

- Personal property limit up to $1 million

- Loss of use limit up to $50,000

- Fixed deductible as low as $500

12.5 Contact Details – Palomar United States (US)

You can contact company through,

| Phone Number | 619-567-5290 |

| Address | 7979 Ivanhoe Avenue, Suite 500. La Jolla, CA 92037 |

| [email protected] | |

| Official Website | https://plmr.com/ |

13. FAQs – Flood Insurance United States (US)

Are there coverage limits for flood insurance?

There are coverage limits for flood insurance policies, yes. It’s crucial to examine your policy and, if necessary, think about getting more insurance.

Is flood insurance available for businesses and renters?

Absolutely, both companies and tenants can purchase flood insurance. Commercial flood insurance is available for purchase by businesses, while personal property insurance is available to renters.

How does flood insurance relate to the National Flood Insurance Program (NFIP)?

Property owners and renters in participating communities can get flood insurance through the NFIP, a federally funded program. The NFIP offers the majority of flood insurance plans in the US.

14. Conclusion – Flood Insurance United States (US)

In conclusion, flood insurance is essential in the US, especially in areas prone to flooding, as it protects households and property owners from the rising risk of flooding. Despite playing a vital part in offering coverage at a reasonable price, the National Flood Insurance Program (NFIP) struggles with issues like financial viability and outmoded flood maps.

The system must be improved going forward by policymakers. To safeguard their investments, homeowners in flood-prone locations should proactively purchase flood insurance. In managing the country’s ongoing flood risk, government assistance and individual responsibility must work together.

If you liked this article, then please do share it on the Social Media. If you have a question or suggestion? Then you may leave a comment below to start the discussion.